Gone are the days when the word ‘loan’ existed only in the dictionary of banks and shylocks. Today, technology is revolutionizing global finance such that people can access credit outside the strict bounds of the financial industry. Notably, the peer-to-peer (P2P) lending industry is one of these mediums.

The global P2P lending platforms industry is massive. At just over a decade old, the industry is growing at an incredible pace. In 2018, the P2P market was worth approximately $15 billion. The valuation will be larger as of year-end 2019 since the factors driving the growth are holding strong.

Notably, technology is the biggest influence on the growth of the industry. This is because of the structure of the market. Particularly, the lending platforms simply connect borrowers and lenders directly without a middle player. As such, there is no place for players like banks and other financial institutions in this market. In this case, borrowers can access cheaper loans and without the rigor that they would experience when borrowing from banks.

An increasing number of students across the globe are preferring the platforms because the loan rates are less punitive. Further, the cost of entry into the industry is less for businesses since they do not have to deal with things like staffing, maintenance of physical offices, among other operational expenses.

Which countries are aggressively pursuing the industry?

The P2P lending platforms industry is big in countries where financial technology (FinTech) is massive. For example, the industry is worth $2 billion in the United States. Between 2014 and 2019, IBIS World established that the industry in the US expanded at an annual rate of 32.5%.

Driving the growth and adoption of the P2P lending market in the US are companies like Upstart, Lending Circle, Funding Circle, and Prosper Marketplace. The companies facilitate lending for various purposes including refinancing and credit card debt consolidation. Other types of loans that are popular on the platforms in the US include home loans, personal loans, vehicle refinancing, and small business loans.

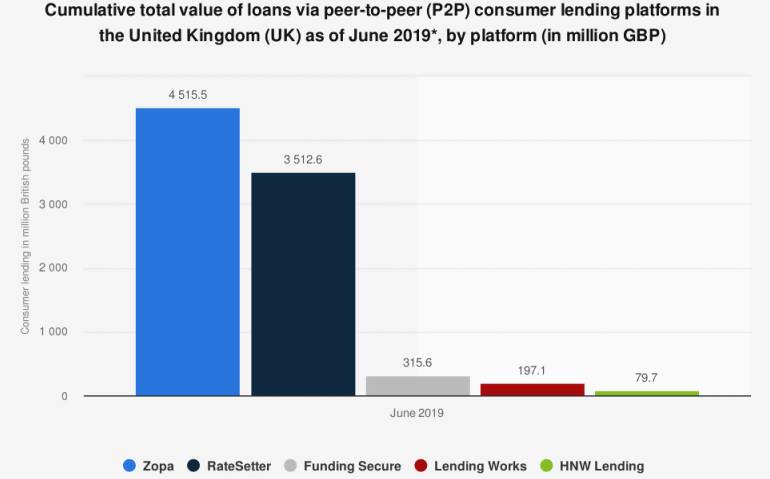

The United Kingdom is another country with serious P2P lending ambitions. IBIS World stated that the industry started in the UK in 2005. Notably, the total loan value among the top five players in the UK as of June 2019 amounted to £8,620.5 million ($11,223.98 million).

What are the sectors where the application of the industry is most today?

The P2P lending platforms industry is huge in the small business sector. Particularly, many small businesses worldwide face many challenges when sourcing for funds from banks to scale their operations. For instance, banks demand long and near-perfect credit history before they give out loans. However, P2P lending platforms are less demanding in that respect hence making it easy for small businesses to acquire crucial funds.

The largest lending platform for the small business sector is Funding Circle. Notably, the platform focuses exclusively on bringing lenders who want to extend loans to small businesses. The UK-based lending platform leverages crowdfunding to source funds for access by small businesses. Other sectors where the platforms are most applied today include the personal loan sector, and vehicle loan financing among others.

Industry outlook

A report (pdf) by the European Banking Authority (EBA) noted that the increased penetration of the internet is the biggest driver of the industry’s growth. Further areas, where the density of banks is low, seem to be more attractive for users of the lending platforms. According to the analysis of the EBA, countries that have a more concentrated banking structure have seen a slow growth of the P2P lending platforms.

Between 2018 and 2024, it is estimated that the market will grow at 19% CAGR clocking $44 billion in 2024. Particularly, the increasing number of borrowers will be the biggest driver of this growth.