The impact of a potential recession on startups is different than its effect on large companies because of their different structures, says the director of Startup Portugal, who believes that entrepreneurs thrive on challenges.

Startups are different than large corporations in nature and act differently when it comes to industry recession or real estate recession, João Mendes Borga told Via News in an exclusive interview shortly before the coronavirus pandemic left the world economy teetering on the brink of a recession.

The outbreak of COVID-19—a coronavirus-caused illness that originated in Wuhan, China, late last year—is considered one of the most significant public health crises in decades. It has spread far wider than Ebola did in 2014.

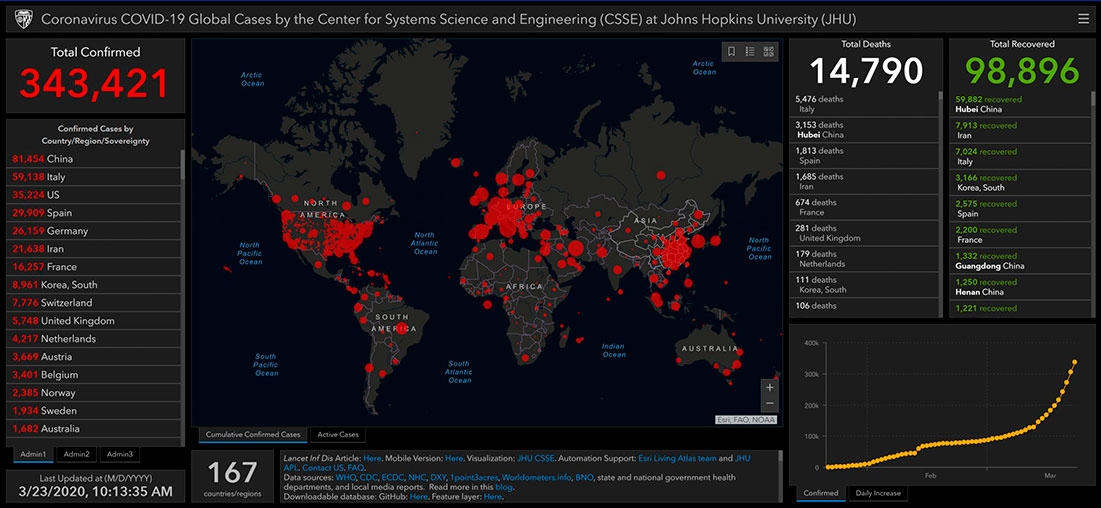

Over 343,000 people worldwide have so far been infected, with the hardest-hit countries being China, Italy, the United States, Spain, and Germany at the moment, according to the data released by the Center for Systems Science and Engineering at Johns Hopkins University on March 23.

A total of 14,790 people have died of COVID-19, the disease caused by the coronavirus, while around 99,000 patients have recovered.

Situation in Europe

The pandemic, which has put the affected countries under lockdown and disrupted businesses all over the globe, has raised the risk of an economic downturn across Europe—the epicenter of the outbreak outside of China.

European Central Bank vice president Luis de Guindos said on Sunday that the repercussions of the coronavirus outbreak will put Europe into a recession but it should be transitory and the region will see positive GDP growth in the second semester.

“This impact will be very hard and will place Europe into a recession,” de Guindos said in an interview with Spanish TV La Sexta channel, Reuters reported.

“I believe that the first semester will be very bad. Europe will enter into a recession, and this will drag the overall European economy into negative growth rates in the year. But in the second semester, I believe we will see positive growth rates for Europe,” he added.

If Europe is gripped by a recession, it means that the global economy could also be headed that way.

The repercussions of the coronavirus outbreak will put Europe into a recession but it should be transitory.

European Central Bank vice president Luis de Guindos

Global Recession

In a video conference on Thursday, United Nations Secretary-General Antonio Guterres said a global recession is on the horizon, AP reported.

“A global recession—perhaps of record dimensions—is a near certainty,” he warned, citing a report by the International Labor Organization that said workers around the world could lose $3.4 trillion in income by the end of this year.

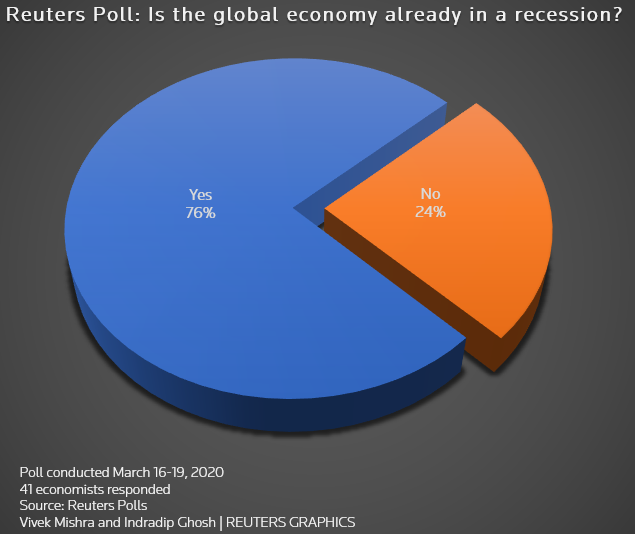

Economists polled by Reuters say the global economy is already in a recession given the widespread impact of the coronavirus pandemic on economic activities.

“More than three-quarters of economists based in the Americas and Europe polled this week, 31 of 41, said the current global economic expansion had already ended, in response to a question about whether the global economy was already in recession,” the news agency wrote on Friday.

“Last week we concluded that the COVID-19 shock would produce a global recession as nearly all of the world contracts over the three months between February and April,” noted Bruce Kasman, head of global economic research at JP Morgan, according to Reuters.

Impact on Startups

The director of Startup Portugal—a public-private think tank that serves as a medium between the government, entrepreneurs, incubators, and accelerators—says difficult economic conditions could result in the emergence of new startups.

For instance, the financial crisis in Portugal that reached its peak between 2011 and 2013 led to an increase in the number of startups and activities at the entrepreneurial level, added João, who has previously worked as a special advisor at the Ministry of Economy.

“One of the reasons is that people are trying to sort themselves out to find their things away from big corporations. The second reason is that [an economic downturn] creates an opportunity for people to help reduce costs and solve problems in a leaner and faster manner.”

The possibility of an entrepreneur building a good company that could thrive on challenges increases in light of such opportunities, he commented.

“I know many companies that were created in 2012 and 2013 that built their business models based on being lean and frugal and are now good scaleups,” said the director of Startup Portugal.